State by State: Reporting Recreational Cannabis Sales

By Ben on September 3, 2018

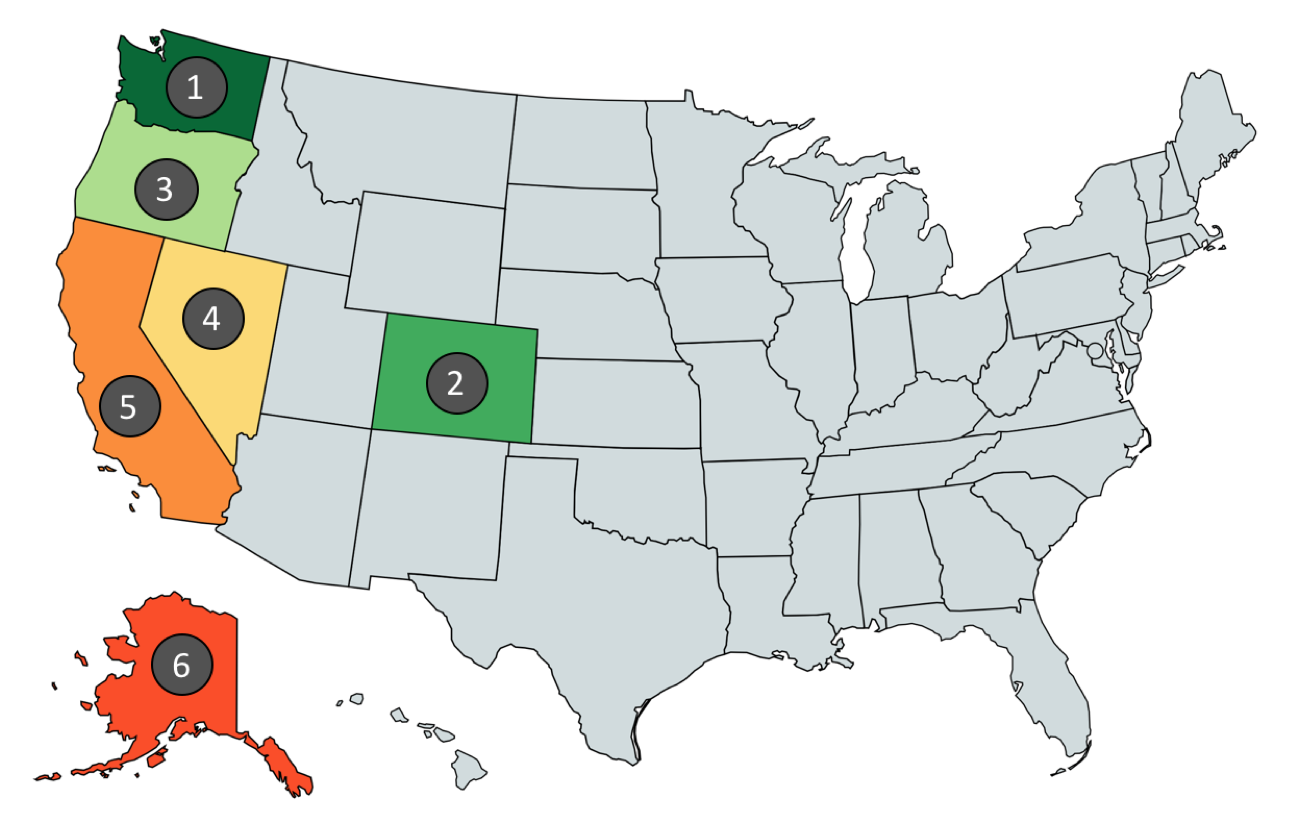

Each of the six states that currently allow recreation sales have taken a different approach in releasing sales data – and some are much more forthcoming than others. Green Growth Analytics has ranked each state with legal cannabis based on how much detail and how frequently they publish sales data for recreational (and, where applicable, medical) cannabis.

Washington took the top spot – they provide monthly data on medical and recreational sales, with breakouts by county and product type, down to individual retailers and processors. In contrast, Alaska ranked last and provides only monthly tax revenue collected at the wholesale level. Here are the rankings:

1. Washington

Washington publishes more data about recreational cannabis sales than any other state. They offer detailed monthly sales and production figures by county, product type, retailer, and processor. They have an excellent API, which allows developers and others to directly access state data, and they have produced an annual report in previous years with even more information.

2. Colorado

Colorado publishes both monthly Marijuana Sales Reports, which are based on self-reported, unaudited sales tax returns, and Marijuana Tax Data Reports, which show tax revenue collected. Sales data is broken down by county and medical vs. recreational. In addition, the state has published a much more detailed annual report on the state of the marijuana industry.

3. Oregon

The Oregon Liquor Control Commission publishes monthly sales figures for medical and recreational cannabis, with breakouts by product type, but these figures haven’t been updated for the last two months. The Oregon Department of Revenue also publishes tax receipts for cannabis products on a monthly basis but does not offer breakouts by product type or location.

4. Nevada

The Nevada Department of Taxation publishes monthly sales figures for wholesale and retail excise taxes collected as well as taxable sales reported by dispensaries. No breakdowns by location or product are given.

5. California

California, which began legal sales in January 2018, has published quarterly figures for sales tax, excise tax, and cultivation tax. Because medical marijuana is exempt from sales tax in California, it can be used calculate how much medical and recreation cannabis has been sold, but there are no other breakouts. California has published the quarterly numbers through news releases, however, so there is no guarantee they will continue into the future.

6. Alaska

Alaska does not disclose cannabis sales data. Instead, the Alaska Department of Revenue publishes how much tax it has collected for both bud and flower (taxed at $50 per ounce) and the remainder of the plan (taxed at $15 per ounce). Because the tax is only levied at the wholesale levy, it can only be used to estimate, not calculate, retail sales. Alaska does not offer any breakdowns by location, products category, or anything else.